As per EY, a global leader in providing industry insights, “Business lending may improve by 2024 as businesses, particularly SMEs continue to deal with the economic shocks.” As a result of this slowdown, only 0.9% growth is expected in 2024. The reason behind this slowdown is slashed supply chain disruption, low sales, and high-cost debt. Apart from this, complicated and lengthy loan applications dissuade businesses from leveraging external finance for goals.

However, the good news is consumer credit which is 4.8% this year, may increase to 5.3% in 2024. The country may not witness an improvement in the first half of the year. It may encounter a prospective recovery in the second half.

As a part of the recession, UK businesses may witness a spike in interest costs to 0.8% in 2023. But it may soon fall to 0.6% in 2024 following the financial recovery.

The primary reason behind this is the big lending policy CHANGE.

With Brexit, financial institutions may provide resilient support to businesses by adopting digital innovation, sustainability, and strong governance as the core parameters.

It is the reason businesses resort to business loans. Various options, ease of qualification, and flexibility make it popular.

What are Long-term Business loans?

Long-term loans for businesses are a flexible mode to meet operational requirements. One generally borrows it for 5 years or more. It works much like another loan where the lender provides the sum requested, and you pay in monthly instalments for the loan tenure. It grants sufficient time to businesses to revise their strategy and pay the loan back comfortably. Moreover, the terms are easier to qualify for than short-term lending.

According to Shopify,

Only 24% of businesses qualify for the requested amount in short-term lending.

Long-term loans give you the capital to grow as part of your borrowing strategy. Whether you need to update your inventory, hire, update equipment, or buy it on a lease, long-term finance can assist you in every goal. The interest rates and other terms are affordable for short-term loans. You may pay lower monthly payments. Interest costs may apply. Under long-term loans, you can apply for unsecured and secured business loans.

How do unsecured business loans differ from secured ones?

Business loans can be either secured or unsecured. You can decide among these according to your circumstances. Here is the detailed difference between the two:

| Unsecured business loans | Secured business loans |

| You can borrow up to £500000 without putting up any security as collateral on the loan. | You can borrow up to £2 million by putting up business assets like – machinery, office space, invoice, and equipment as collateral. |

| The interest rates on unsecured business loans are high due to the risk involved for the lender. Thus, lenders may ask for a personal guarantee. | These loans have competitively low-interest rates as lender share full security to claim the dues if one defaults. |

| These have shorter repayment terms like- 1 year | Secured business loans have longer repayment terms |

| Fast application process with no collateral involved. One may qualify with a good business credit score, revenue scale, and business plan. | The application and fund release process requires time to assess the asset and business credit score and finances. One may qualify quickly by providing asset valuing more than the amount needed. |

Improvise the lender’s requirements and the collateral eligibility as per personal agreement to get the loan instantly. It is important because, as per Shopify.”

“Around 33% of loan applications suffer rejection due to insufficient collateral to secure the debt.”

To avoid any such glitches, spot the right way to approach long-term business finance. If you cannot go for a collateral one, an unsecured business loan may help. You can benefit from low credit for small needs as some lenders provide business loans with no credit check in the UK market. The lenders only conduct a sift credit check that does not impact a credit score. You can use it to finance urgent inventory updates, repair machinery, etc.

How to approach long-term business finance?

You can figure out your needs and apply for the best option easily. Understand whether you would need a secured or unsecured loan. The process is almost similar, but secured ones may be time-consuming. Here is the step-by-step way to approach long-term business loans:

1) Know the loan eligibility criteria

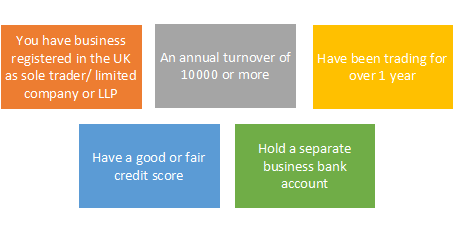

Whether or not you may qualify for a business loan depends on the operating history, revenue, and business plan. You can get one if:

If you are applying for a secured business loan, you would additionally need an asset to secure the loan. However, you may also qualify for better rates with a low credit score.

However, most individuals struggle to get an unsecured loan.

Self-employed individuals may struggle to qualify if unemployed or working in finance. They may require additional support to qualify. However, some may get long-term loans for the unemployed with no guarantor with consistent efforts to gain new projects or new projects in hand.

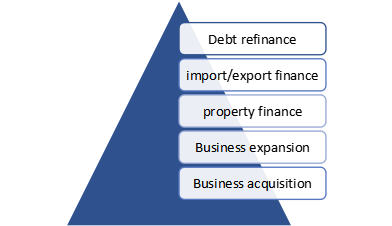

2) Analyse the purpose you want to use the loan for

It is important to analyse the purposes for which you can legally use a business loan.

3) Identify the total loan costs using a calculator

If you wonder what your monthly payments would look like, a loan calculator can help. Here is an example:

If you need a long-term business loan of £30000 for 7 years to acquire a business at an interest rate of 3.4%, your total monthly payments will be £4344.42, your total interest costs- £48.71, and your total loan amount for the loan term would be £30340.94.

This is an example of how loan repayments and interest work. Knowing the tentative costs helps decide right and budget accordingly.

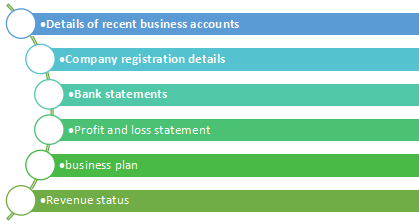

- Provide the needed documents

Once you find the loan affordable, apply for it online. Lenders may ask for specific and authentic documents before approving a loan. You may have to provide details like:

- Consider the repayments and interest rate type

After providing the documents, analyze the right repayment tenure for your loan. You can choose a fixed or variable interest on a long-term loan. If the economy is well, you may benefit from invariable interest rates.

Likewise, in an unstable economy and opting for secured loans, check fixed interest rate loans. It implies that the repayment amount may fluctuate in invariable interest rates and remains constant in fixed interest rates.

Parting lines

After finding the ideal repayment term and interest rates, sign the agreement. You are good to go! The step-by-step long-term business loan application process may help you qualify for better rates. You should be clear about the purpose, capital, assets, business plan, and amount you need to finance.